Employee Master

To create employee master data, you can create it with the following steps.

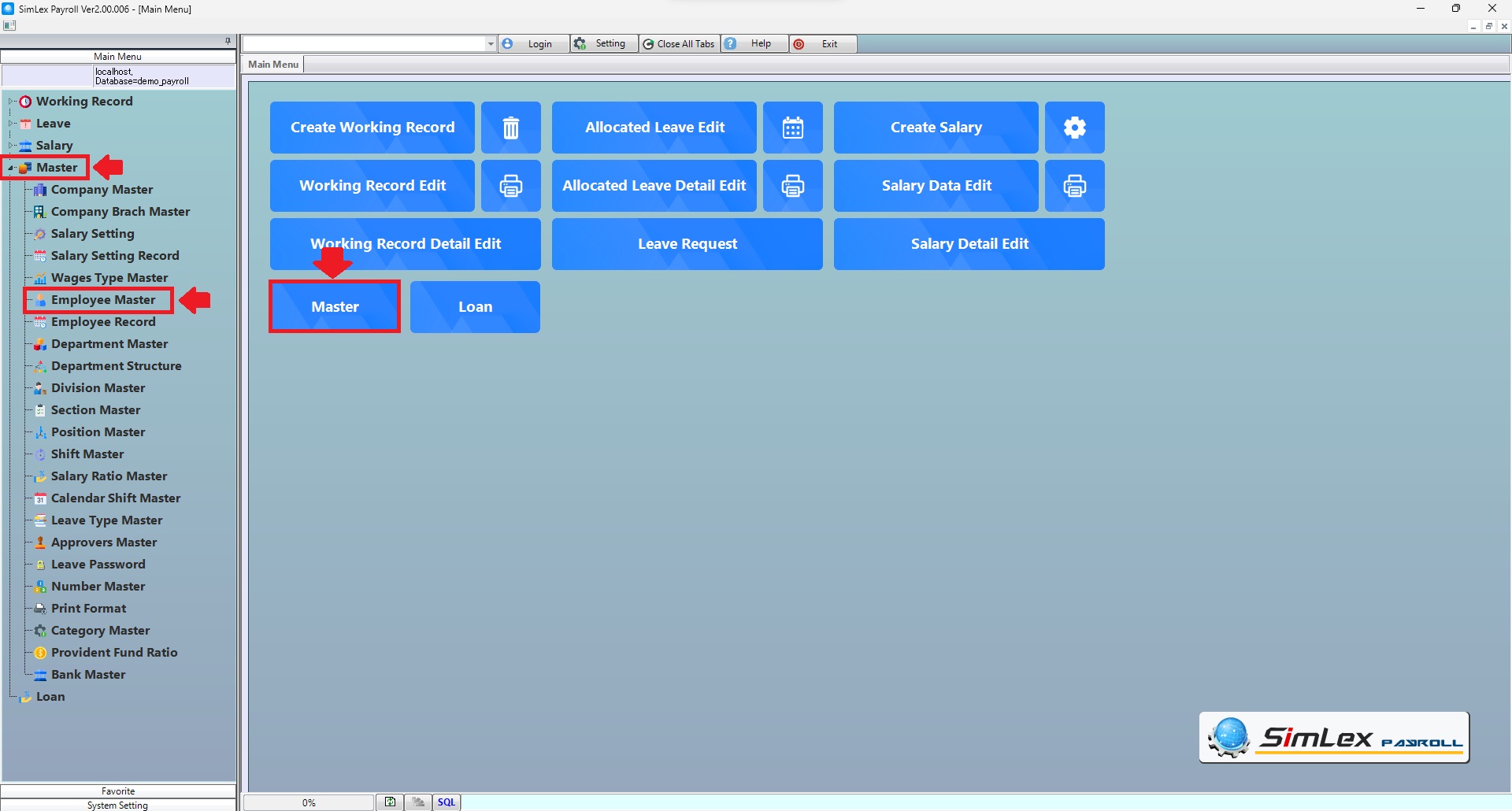

1. Click <Master> from the main menu or double click from the left menu <Master> and then double click on the menu <Employee Master>.

Picture 1 Click menu Employee Master.

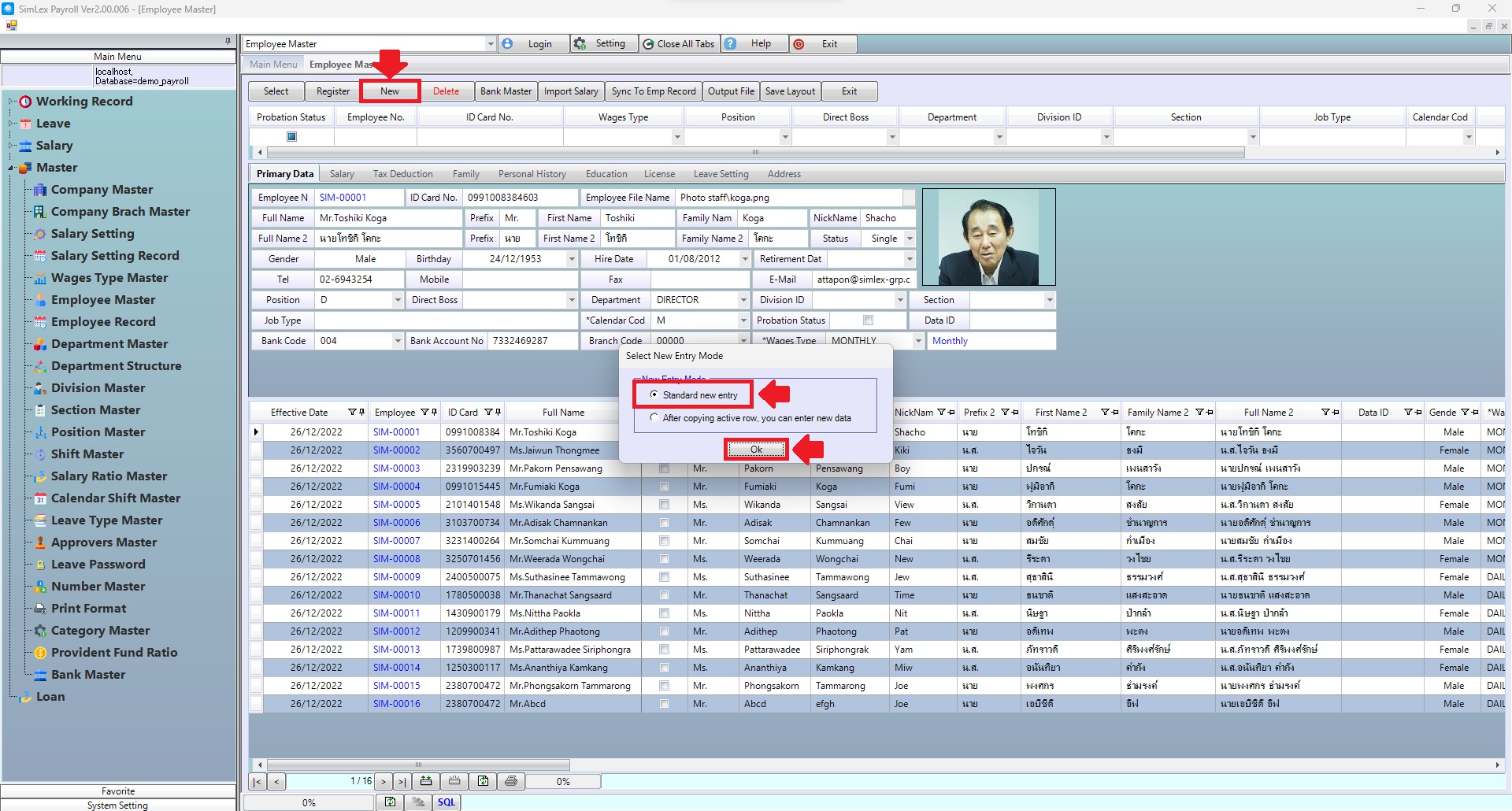

2. The system will display an information window. Click then <New> then click <Standard new entry> then finished click <OK>.

Picture 2 Standard new entry.

When the system displays the information, click on the Sheet <Primary Data> that you want to fill in information. When finished filling in information in each sheet, click <Add> and edit the date in the fields <Effective Date> to allow data to be processed from the date entered onwards. And when the information is complete, click <Register>.

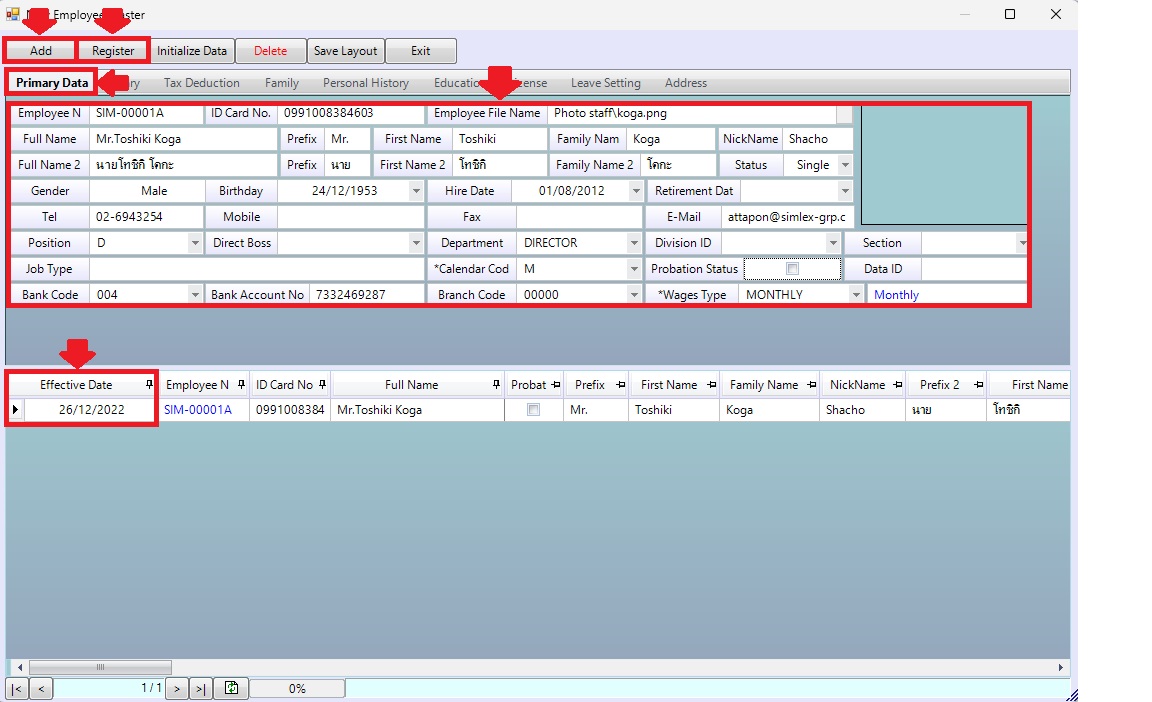

2.1 Sheet <Primary Data>.

Picture 3 Sheet <Primary Data>.

| Field name input data | Information input detail |

| Employee No | Enter employee no. |

| ID Card No. | Enter id card no. |

| Employee File Name | Select employee file name. |

| Full Name | Enter full name. |

| Prefix | Enter prefix. |

| First Name | Enter first name. |

| Family Name | Enter family name. |

| Nick Name | Enter nick name. |

| Full Name 2 | Enter full name 2 (User for submit Tax and SSO). |

| Prefix | Enter prefix (User for submit Tax and SSO). |

| First Name 2 | Enter first name 2 (User for submit Tax and SSO). |

| Family Name 2 | Enter family name 2 (User for submit Tax and SSO). |

| Status | Select status Single, Married, Widowed, Divorced, Separated. |

| Gender | Select gender. |

| Birthday | Select birthday. |

| Hire Date | Select hire date. |

| Retirement Date | Select retirement date. |

| Tel | Enter tel. |

| Mobile | Enter mobile. |

| Fax | Enter fax. |

| Enter e-mail. | |

| Position | Select position. |

| Direct Boss | Select direct boss. |

| Department | Select department. |

| Division ID | Select division id. |

| Section | Select section. |

| Job Type | Enter job type. |

| Calendar Code | Select calendar code. |

| Probation Status | Check box for probation status. |

| Data ID | Enter data id. |

| Bank Code | Select bank code. |

| Bank Account No | Enter bank account no. |

| Branch Code | Select branch code. |

| Wages Type | Select wages type. |

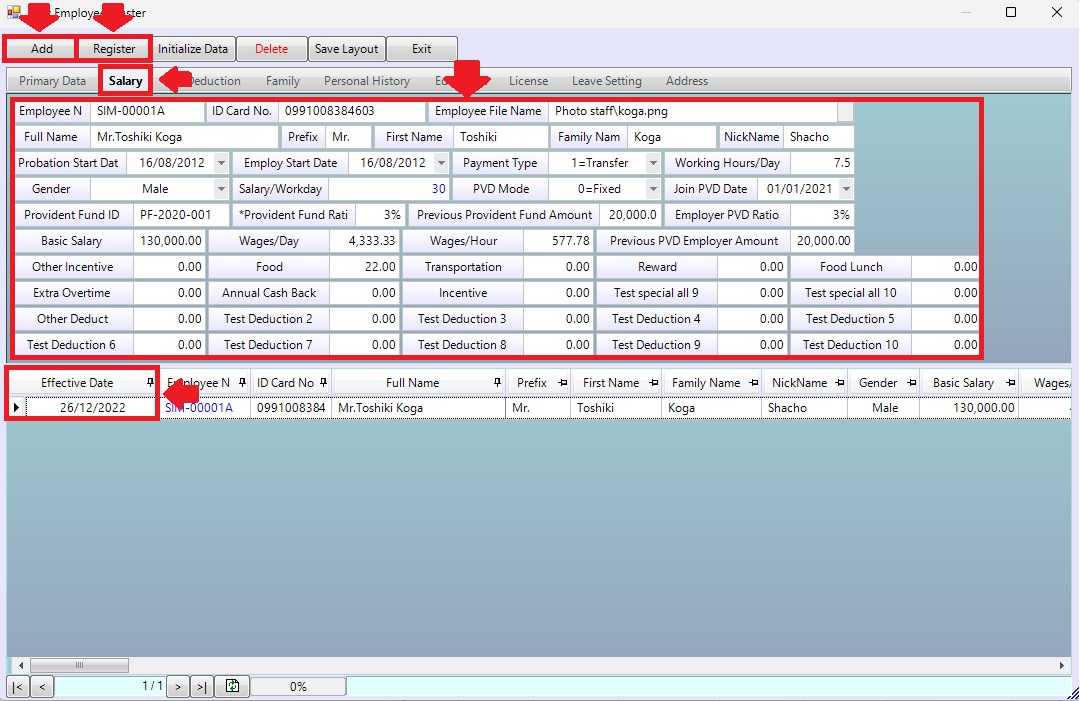

2.2 Sheet <Salary>.

Picture 4 Sheet <Salary>.

| Field name input data | Information input detail |

| Probation Start Date | Select probation start date. |

| Employ Start Date | Select employ start date. |

| Payment Type | Select payment type 0=Cash, 1=Transfer, 3=Cheque. |

| Working Hours/Day | Enter working hours/day. |

| Gender | Select gender Male, Female, Other. |

| PVD Mode | Select PVD mode 0=Fixed, 1=Auto |

| Join PVD Date | Select join PVD date. |

| Provident Fund ID | Enter provident fund id. |

| Provident Fund Ratio | Enter provident fund ratio (Company) |

| Previous Provident Fund Amount | Enter previous provident fund amount. |

| Employer PVD Ratio | Enter provident fund ratio (Employee) |

| Basic Salary | Enter basic salary. |

| Wages/Day | System auto display. |

| Wages/Hour | System auto display. |

| Previous PVD Employer Amount | Enter previous PVD employer amount. |

| Other incentive | Enter special allowance amount. |

| Food | Enter special allowance amount. |

| Transportation | Enter special allowance amount. |

| Reward | Enter special allowance amount. |

| Food Lunch | Enter special allowance amount. |

| Extra Overtime | Enter special allowance amount. |

| Annual Cash Back | Enter special allowance amount. |

| Incentive | Enter special allowance amount. |

| Test special all 9 – 10 | Enter special allowance 9-10 amount. |

| Other Deduct | Enter deduction amount. |

| Test Deduction 2 – 10 | Enter deduction 2-10 amount. |

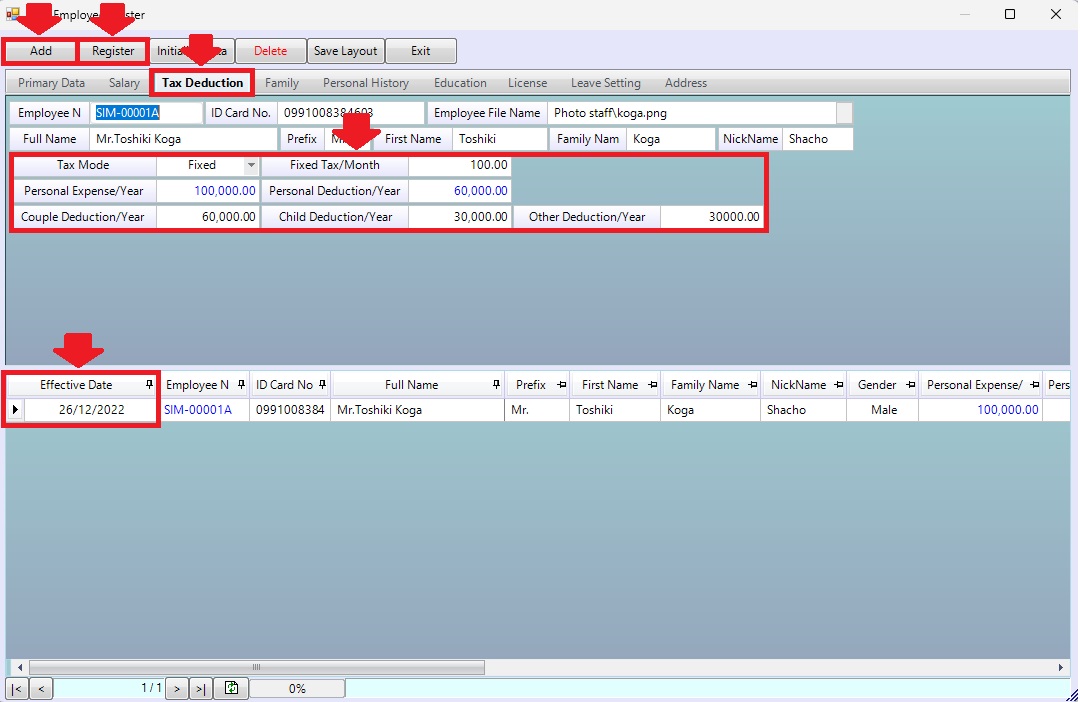

2.3 Sheet <Tax Deduction>.

Picture 5 Sheet <Tax Deduction>.

| Field name input data | Information input detail |

| Tax Mode | Select Tax Mode Fixed(Manual tax amount/Mount), Auto(คำนวณตามอัตราก้าวหน้า) |

| Fixed Tax/Month | กำหนดจำนวนเงินยอดภาษีเองต่อเดือน |

| Personal Expense/Year | กำหนดจำนวนเงินลดหย่อนค่าใช้จ่ายส่วนบุคคล/ปี |

| Personal Deduction/Year | กำหนดจำนวนเงินลดหย่อนส่วนบุคคล/ปี |

| Couple Deduction/Year | กำหนดจำนวนเงินลดหย่อนภรรยา/ปี |

| Child Deduction/Year | กำหนดจำนวนเงินลดหย่อนบุตร/ปี |

| Other Deduction/Year | กำหนดจำนวนเงินลดหย่อนอื่นๆ/ปี |

| Field name Main menu | Search for details of information |

| Wages Code | Enter wages code. |

| Field name input data | Information input detail |

| Wages Code | Set wages code. |

| Wages Name | Set wages name. |

| Calculation Type | Select calculation wages type 0=Monthly, 1=Daily. |

| Fix flag | System auto check box. |

| Salary/Workday | System auto display data. |

| This Year | Set start year. |

| This Month | Set start month. |

| Cal Paid Holiday | Check box for calculate paid holiday. |

| Start Days | Set start day salary. |

| Close Days | Set close day salary. |

| Pay Salary Day | Set pays salary day, incase end of month it will be scheduled to be paid at the end of each month. |